Protesting Your Assessment to Lower Your Property Taxes

Real Estate Property Taxes are Assessed Annually on Texas Homes.

The amount we pay to the appraisal district for property tax is a simple equation. The dollar value the taxing jurisdiction puts on our property X the annual tax rate for the county in which we live. Each year Texas counties have the opportunity to reassess the property’s value and later each year, they set the actual tax rate.

In my real estate career, I often meet homeowners that do not understand the difference between Appraised Value for taxes and Resale Value of their home. The Appraised Value is what our taxes are based on and is not necessarily our Resale Value. A high taxable value does not mean our homes will sell for more when the time comes. It does mean we pay more taxes. It’s my goal to help fellow neighbors and homeowners understand the difference and keep as much money in their pockets as possible. Therefore, I spend a large amount of time, during the spring, helping homeowners prepare for our tax appraisal protests.

Check out the video above and reach out about protesting your property taxes! Hint: Hurry…protest deadline is May 15th!

What to Expect?

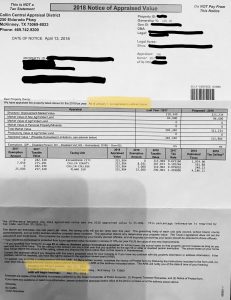

When the updated value is set, as homeowners we receive the Notice of Appraised Value letter from the county. In the Dallas Fort Worth Metroplex, our notices come out mid-April. It is important to watch for this notice in the mail and act quickly because we have a short timeframe in which to plead our case. The typical deadline is 30 days after we receive the notice or May 15th, whichever is later. Last year I received my notice on April 17, as many other homeowners did and that leaves us precious little time to research and plead our case if we believe the new taxable value is too high. Near the end of this year, typically in October, we will receive our actual tax bill calculating the updated Appraised Value multiplied by the current Tax Rate with a deadline to pay the annual taxes by January 31st of the next calendar year, but that is information for later and now we must focus on the current deadline.

Although we all pay property taxes, it’s important to confirm that we each pay our fair share based on the true value of our homes and land. Many homes can get overvalued. Tax assessors have a big job and often apply a general percentage increase across the board to the majority of properties, simply because there is not enough time to evaluate each property individually every year. As homeowners, it’s up to us to review the updated value of our properties and file a property tax protest if we disagree with the value.

What are our Options if We Disagree with the Appraised Value?

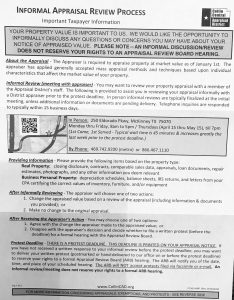

There are several options, in most Texas counties, to protest our taxable value. Some counties allow you to file your protest online, some offer a phone interview and most will allow us to come into their office and sit down with a property appraiser for an informal review. My opinion is that the last option, an informal review is best, initially. If we do not come to a reasonable agreement with the appraiser at this meeting, we do have the option to request a Formal Review with the Appraisal Review Board. If we plan to go before the Appraisal Review Board, we have to file that intention before the May 15 deadline. That appeal will take place after informal reviews are complete or after May 15. The details about how, when and where to protest are included with the Notice of Appraised Value from the county. It’s important to read them carefully, so as not to miss the deadline.

After Receiving Your Assessment Letter, Consult a Realtor.

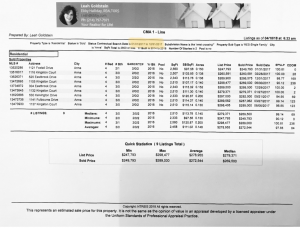

As a trusted Realtor I can help find 3-5 comparable properties that look to be similar to the property in question. We look for homes that sold the previous year, in the same area and that are similar in size, age and amenity level to use as “comps”. The comps can then be used to support a claim that the property is overvalued.

Typically, I have two kinds of chats this time of year – (1) Great News! 👍🏻We can use recent comps to plead a good case that your property is overvalued and reduce your tax burden. (2) Good News/Bad News! Your property is worth more than we thought, but your tax bill is going up accordingly.

Trusted Realtors will take time to help review statements and pull together a list of comps that will help cases for friends and family. The news this time of year can be stunning if our tax bills are moving up dramatically, but it can also be a reality check about the value of our properties and that it may be the time to consider a move or some upgrades.

We Plan to Meet with an Appraiser. What Evidence Do We Need?

When it’s our time to meet with the county appraiser we need to bring evidence to back up what we think the assessed value of our properties should be. Have a number in mind, because they will ask!

First, if you have Homestead, AND the increase is over 10%, that’s easy. The tax assessor should honor the 10% rule (discussed more below) and lower the value to 10% above the previous year.

Second, if you purchased the property during the previous year, also a bit easier. Take with you a copy of the CD (Closing Disclosure) you signed and received at closing. (Can’t find a copy of that quickly? Reach out to your Realtor or title company, they should have it ready to provide.) The CD is an official document and will show the amount you paid for the property and the appraiser is likely to adjust the taxable value down to the purchase price accordingly.

If neither options above fit your situation, or if you want to have extra ammunition in your pocket, then the comparable homes and other evidence become very important.

Your evidence should include:

- List of Sold comparable homes that we talked about earlier.

- Photos of any defects or outdated features in your property.

- Bids or estimates from contractors to repair or update the property.

For example: If the comparable homes that sold the previous year show an average sales price of $300,000 and the details of those homes show new carpet, fresh paint, updated appliances and even list new fences and roofs, due to storms we have had over the past few years, but your home doesn’t include those updates, you have justification for a dispute. You can argue that your home needs more updating – cosmetically or mechanically (or both) – than the homes that were updated and sold.

In this case, we will need proof. Photos are the best proof. Take photos of those items that need are in need of repair or just very outdated. Does your pool need replastering and you just haven’t gotten around to doing it over the winter? Have you been waiting until it warms up to get out and do some big outdoor projects? These are the projects we all have been wanting to do around our homes, but haven’t done yet and may not get to until we are ready to move and the Realtor we hire suggests it’s time. 😉

Then you will need a bid or an estimate from a reliable contractor. The bid should match up with the photos and give an accurate estimate of what it will cost to get the property “up to par” with the others that have sold.

The Majority of Appeals are Successful.

Why are most appeals successful? Because a large percentage of homeowners do not appeal. So the ones that do and have reasonable evidence of a reduction will get the benefit of a lower tax bill. But keep in mind the Dallas Fort Worth housing market has been moving up quickly over the past few years and so has the taxable value of our properties.

Most homes I see need something. Not always and not always big-ticket items, but if your property needs work, cosmetic or otherwise, this is your opportunity to share that with the local taxing authority.

Last year when Collin County updated the appraised value of my personal property they wanted to increase the taxable value by $140k – Yes! In one year. That large of an increase was not acceptable. But after meeting with 2 appraisers and pleading my case, the taxable value of my property was dramatically reduced, over $100K! It was “work” but well worth it. Did my taxes still go up? Yes. But I did not just accept the initial increase which would have cost me an additional $4000 annually. I laid out my case and was successful. I want to help you do the same.

First, when our properties are “Homesteaded”, meaning we have applied for and received the State Homestead Exemption (only available for homes we live in, not investment properties), the maximum annual increase is limited to a max of 10%. That can still equate to a big jump. But I can tell you, many of my friends and clients that I have already done work for this week have had exactly a 10% increase. The reason this is common practice is that most homeowners will see the notice come in the mail, open it, make a sour face and just move on. A better response is to review the statement and send a copy of it to a Realtor you trust to help if the value seems inaccurate. If no one comes to mind, snap a photo of it and send it to me, as my friends and clients do. I’ll help. I can’t commit to helping by $100k, but if the value is too high, I can commit to taking the time to help put together a valid argument for your protest.

Think of it this way. This is our opportunity to object to the appraised value and make an effort to save our hard-earned $. We all pay taxes, but we should only pay our fair share. This is why I allot time in my schedule this time of year to help homeowners come up with a plan to protest our new taxable values. Believe me, when we evaluate your home down the road for a possible sale, we will review numbers in the same way, but we will be looking for ways to increase the value, not lower it. These 2 scenarios are different and we approach coming up with value differently for each.

When we talk about taxable value and preparing for your protest, you will likely hear me summarize all the details down to 4 simple steps:

- Be prepared when you meet with the appraiser.

- Stick to the facts and avoid emotional pleas.

- Present your evidence in a simple and well-organized manner.

- Call me when you are done! ☎️

I want to hear the results and review any details that came up so we can add them to the checklist for next year. Then we can Celebrate 🎉 and discuss how to spend those $ on something more fun than taxes!

If you haven’t already, check out Hope’s video about more puppy lattes here!

When you receive your notice, reach out. Every year I hear from many of you requesting help with evidence for your property tax protest. If you think your appraisal is too high, or just want to say HI, contact me. I’d enjoy catching up and really do want to help my friends and family save $ whenever possible! Thank you again for trusting me to help with all your real estate needs.